Questions to Ask Yourself When You're Thinking About Selling

When you make the decision to sell your home, the end goal is to get the best price and most favorable terms in a time-frame that meets your needs. But before the sign goes up in your front yard, there’s a lot to be done to get you and your home in prime selling condition.

7 Helpful Back to School Organization Ideas

Posted in Porch.com by Porch.com

This article originally appeared on Porch.com

Written by Mady Dahlstrom

Skip the stress of staying organized this school year with these helpful DIYs!

The new school year is almost here! Worried about your home staying in tip-top shape during busy school days? Make the back to school transition a breeze by keeping your family and your home organized. From a menu board to a daily closet organizer, stay on track with these helpful tips and tricks that you can DIY at home!

1. Lazy Susan Homework Caddy

Be prepared for the many homework hours ahead of you with this DIY homework caddy. If your kids like to do homework at the kitchen table, this lazy susan homework caddy makes every supply easily accessible.

2. Paper Clutter Organization

Keep your mail and school papers from cluttering your countertops with this wall file folder organization. Categorize the files to your personal needs, such as sports, medical, coupons, and emergency numbers.

3. Kids Closet Organizer

Make your mornings a little easier with this kids closet organizer. With a hanging cubby and iron-on letters you can designate daily outfits for the whole week.

4. Family Command Center

Get the whole family organized by creating a command center! A place for backpacks, filing, to-do lists, keys, and much more, a family command center will keep all of your important items in one area.

5. Meal Planning Board

Plan ahead for the week by organizing your meals with a meal planning board. Whether you’re going out to eat or staying in, your kids will love to help pick out what’s for dinner each week, and it will help you know what should be on your shopping list.

6. Homework Station

Give your kids a creative and inspiring space to learn with a personalized homework station! Gather school supplies, art supplies, and colorful decorations for a fun space to work, learn, and create.

7. Library Book Basket

Never worry about another late library book with this DIY library book basket. A bin dedicated to only library books will make sure you keep library books separate from your personal collection.

Selling Your Home? Price It Right From the Start!

In today’s market, where demand is outpacing supply in many regions of the country, pricing a house is one of the biggest challenges real estate professionals face. Sellers often want to price their home higher than recommended, and many agents go along with the idea to keep their clients happy. However, the best agents realize that telling the homeowner the truth is more important than getting the seller to like them.

There is no “later.”

Sellers sometimes think, “If the home doesn’t sell for this price, I can always lower it later.” However, research proves that homes that experience a listing price reduction sit on the market longer, ultimately selling for less than similar homes.

John Knight, recipient of the University Distinguished Faculty Award from the Eberhardt School of Business at the University of the Pacific, actually did research on the cost (in both time and money) to a seller who priced high at the beginning and then lowered the their price. In his article, Listing Price, Time on Market and Ultimate Selling Price published in Real Estate Economics revealed:

“Homes that underwent a price revision sold for less, and the greater the revision, the lower the selling price. Also, the longer the home remains on the market, the lower its ultimate selling price.”

Additionally, the “I’ll lower the price later” approach can paint a negative image in buyers’ minds. Each time a price reduction occurs, buyers can naturally think, “Something must be wrong with that house.” Then when a buyer does make an offer, they low-ball the price because they see the seller as “highly motivated.” Pricing it right from the start eliminates these challenges.

Don’t build “negotiation room” into the price.

Many sellers say that they want to price their home high in order to have “negotiation room.” But, what this actually does is lower the number of potential buyers that see the house. And we know that limiting demand like this will negatively impact the sales price of the house.

Not sure about this? Think of it this way: when a buyer is looking for a home online (as they are doing more and more often), they put in their desired price range. If your seller is looking to sell their house for $400,000, but lists it at $425,000 to build in “negotiation room,” any potential buyers that search in the $350k-$400k range won’t even know your listing is available, let alone come see it!

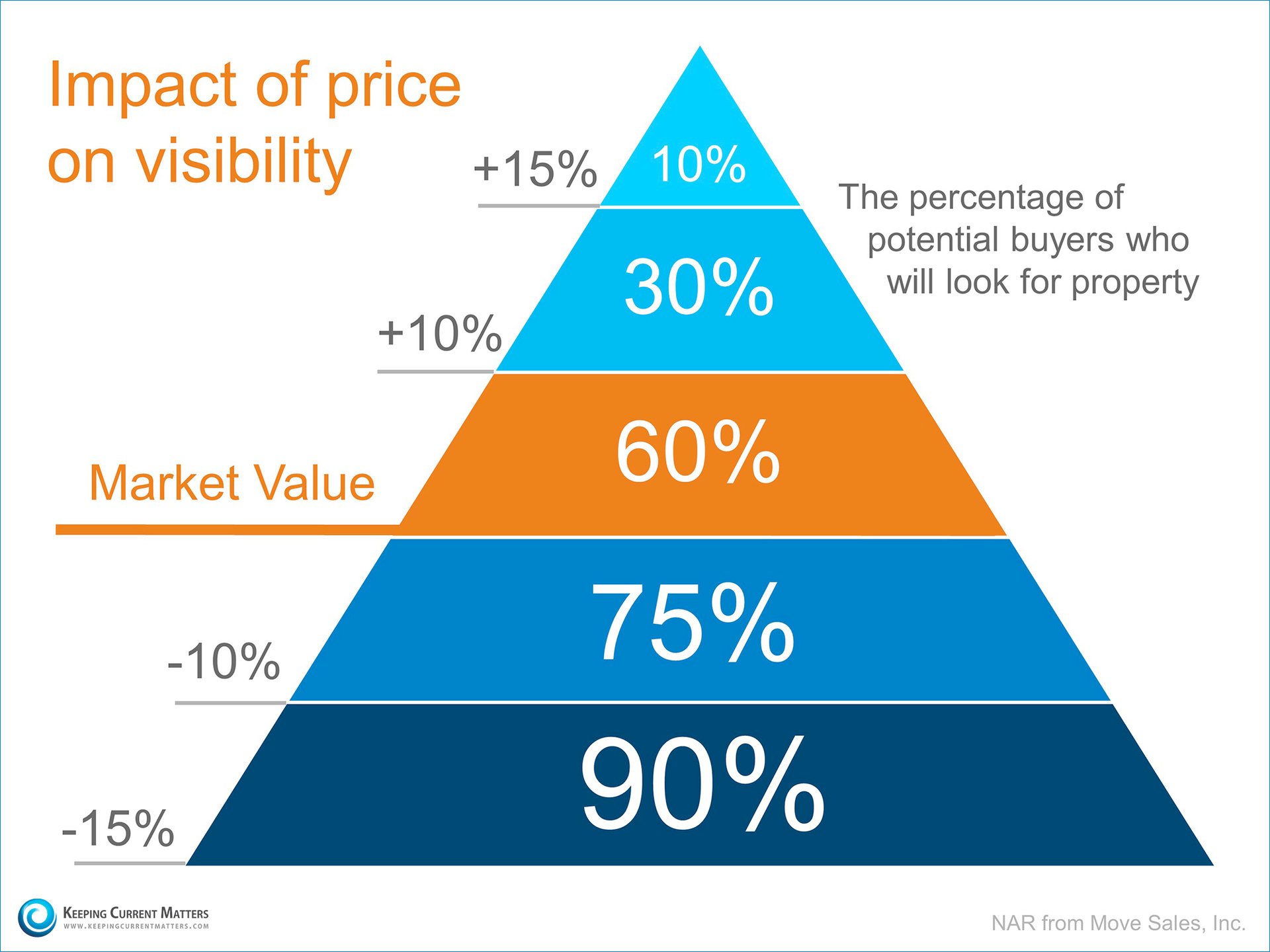

One great way to see this is with the chart below. The higher you price your home over its market value, the less potential buyers will actually see your home when searching.

A better strategy would be to price it properly from the beginning and bring in multiple offers. This forces these buyers to compete against each other for the “right” to purchase your house.

Look at it this way: if you only receive one offer, you are set up in an adversarial position against the prospective buyer. If, however, you have multiple offers, you have two or more buyers fighting to please you. Which will result in a better selling situation?

The Price is Right

Great pricing comes down to truly understanding the real estate dynamics in your neighborhood. Look for an agent that will take the time to simply and effectively explain what is happening in the housing market and how it applies to your home.

You need an agent that will tell you what you need to know rather than what you want to hear. This will put you in the best possible position.

How Long Should They Last?

How long should they last?

Posted in Living by Tara Sharp

Nothing in life lasts forever – and the same can be said for your home. From the roof to the furnace, every component of your home has a life span, so it’s a good idea to know approximately how many years of service you can expect from them. This information can help when buying or selling your home, budgeting for improvements, and deciding between repairing or replacing when problems arise.

According to a National Association of Home Builders (NAHB)study, the average life expectancy of some home components has decreased over the past few decades. (This might explain why you’re on your third washing machine while Grandma still has the same indestructible model you remember from childhood.) But the good news is the life span of many other items has actually increased in recent years.

Here’s a look at the average life spans of some common home components (courtesy of NAHB).

Appliances. Of all home components, appliances have the widest variation in life spans. These are averages for all brands and models, and may represent the point which replacing is more cost-effective than repairing. Among major appliances, gas ranges have the longest life expectancy, at about 15 years. Electric ranges, standard-size refrigerators, and clothes dryers last about 13 years, while garbage disposals grind away for about 10 years. Dishwashers, microwave ovens, and mini-refrigerators can all be expected to last about nine years. For furnaces, expect a life span of about 15 years for electric, 18 for gas, and 20 for oil-burning models. Central air-conditioning systems generally beat the heat for 10 to 15 years.

Kitchen & Bath. Countertops of wood, tile, and natural stone will last a lifetime, while cultured marble will last about 20 years. The life span of laminate countertops depends greatly on use and can be 20 years or longer. Kitchen faucets generally last about 15 years. An enamel-coated steel sink will last five to 10 years; stainless will last at least 30 years; and slate, granite, soapstone, and copper should endure 100 years or longer. Toilets, on average, can serve at least 50 years (parts such as the flush assembly and seat will likely need replacing), and bathroom faucets tend to last about 20 years.

Flooring. Natural flooring materials provide longevity as well as beauty: Wood, marble, slate, and granite should all last 100 years or longer, and tile, 74 to 100 years. Laminate products will survive 15 to 25 years, linoleum about 25 years, and vinyl should endure for about 50 years. Carpet will last eight to 10 years on average, depending on use and maintenance.

Siding, Roofing, Windows. Brick siding normally lasts 100 years or longer, aluminum siding about 80 years, and stucco about 25 years. The life span of wood siding varies dramatically – anywhere from 10 to 100 years – depending on the climate and level of maintenance. For roofs, slate or tile will last about 50 years, wood shingles can endure 25 to 30 years, metal will last about 25 years, and asphalts got you covered for about 20 years. Unclad wood windows will last 30 years or longer, aluminum will last 15 to 20 years, and vinyl windows should keep their seals for 15 to 20 years.

Of course, none of these averages matter if you have a roof that was improperly installed or a dishwasher that was a lemon right off the assembly line. In these cases, early replacement may be the best choice. Conversely, many household components will last longer than you need them to, as we often replace fully functional items for cosmetic reasons, out of a desire for more modern features, or as a part of a quest to be more energy efficient.

Are extended warranties warranted?

Extended warranties, also known as service contracts or service agreements, are sold for all types of household items, from appliances to electronics. They cover service calls and repairs for a specified time beyond the manufacturer’s standard warranty. Essentially, warranty providers (manufacturers, retailers, and outside companies) are betting that a product will be problem-free in the first years of operation, while the consumer who purchases a warranty is betting against reliability.

Warranty providers make a lot of money on extended warranties, and Consumers Union, which publishesConsumer Reports, advises against purchasing them. You will have to consider whether the cost is worth it to you; for some, it brings a much needed peace of mind when making such a large purchase. Also, consider if it the cost outweighs the value of the item; in some cases it may be less expensive to just replace a broken appliance than pay for insurance or a warranty.

Home Offices

This Room is Becoming a Must-Have Home Feature

It’s easy to work in any room of a house with today’s mobile technology. But according to designers and home builders, the home office is becoming one of a home’s must-have features, states Amy Hoak, personal finance editor for marketwatch.com.

The home office is growing in importance as people do more work away from the office and kids do more work outside of the library. Dedicated office space might not always be a full room. In fact, it might be a nook with desk space on the landing of a staircase or a corner of a bedroom or family room.

“That office or desk space is becoming as essential as the family room,” said Mollie Carmichael, who leads the consumer research team at John Burns Real Estate Consulting, based in Irvine, Calif. And that’s true no matter how large of a home it is, from a small apartment to a large single-family home, she added.

According to the survey by John Burns, 77% of the people surveyed said that any additional rooms not dedicated as bedrooms would be used as an office in their next home – the most popular response. (Fifty-six percent said they’d use the extra space as a guest room, 25% said multipurpose room.)

There’s also some evidence that home offices can make a home more attractive to buyers. According to Remodeling Magazine’s 2014 Cost versus Value report, you can recover an average 48.9% of the cost of a home office remodel at resale, up from 43.6% in 2013 and 42.9% in 2012. A midrange office remodel, as defined by the report, is a $28,000 investment that involves installing custom cabinets that include 20 feet of laminate desktop, a computer workstation and wall cabinet storage, along with rewiring of the room for computer, fax machine, cable and telephone lines.

There are a couple of reasons that people are demanding a dedicated office space. The first is that it gives them a place to collect all the paperwork and miscellaneous stuff that they need to run the household, and provides a space for the work they may be doing at home for their job. Secondly, it’s helpful to have a space that is dedicated to work and not filled with other distractions. Having all the things they need within arm’s reach can help with focus.

Those who regularly work from home are more apt to want an office space away from the center of the house. The number of people who work from home on a regular basis (and are not self-employed) grew by 89.8% from 2005 to 2013, to 3.5 million employees, according to data from Global Workplace Analytics, a consulting and research firm that studies work-at-home trends. The most recent statistics show that 2.5% of the workforce works from home at least half of the time.

Those who don’t regularly work from home may want the office space on the first floor, close to the center of the home. Workspace near the kitchen or great room can make it easier for parents to keep their eyes on kids – whether it’s the adults or the children who are working at the desk space. With an open office area, kids are also prevented from sequestering themselves in their rooms with laptops.

Posted on Porch.com

Posted July 31 2015, 2:45 PM PDT by Porch.com

August Maintenance Guide

Posted in Porch.com by Porch.com

This article originally appeared on Porch.com

Written by Anne Reagan

August is a great month to enjoy the last part of summer. Days are hot, flowers are in bloom, and many people choose August as the perfect month to leave on one last summer holiday before the busy fall begins. If you enjoy working in the garden, you’ll find that August is a great time of year to harvest fruits and vegetables, trim back foliage and tend the soil. Watering may be occupying much of your time. You’ll want to read our tips about water conservation and ways to save water in the yard. If you have a swimming pool in your yard, or live near a body of water, be sure all of your guests know swimming safety basics. Sadly, children have a high rate of drowning or injuries related to swimming, and many of these incidents can be preventable. Read our swimming safety tips here.

Inside the home you might find it to be a good time to get organized before the fall. Cleaning out closets, donating unused items, and really cleaning under the bed can be a great way to get a handle on clutter. You might also want to make a “honey do” list of all the things around the home you haven’t had time to do. Hanging pictures, fixing a dripping faucet (watch our how-to video here), purchasing new water filters for the refrigerator….the list can sometime feel long. Take the time to find professionals in your area that can help you get these tasks done before the weather turns and days feel shorter. This is also a great time of year to book your winter-related professionals now like chimney sweeps, attic insulation specialists and tree trimmers. Put them on the calendar now and you’ll start the fall season feeling organized.

Here are some other tasks you can do this month:

Exterior

- Check roof and replace loose/missing/damaged shingles

- Replace any missing mortar (if your home is made of brick)

- Seal chimney to prevent small animals from entering

- Check AC refrigerant levels. If levels are low it could indicate a leak.

- Repair cracks in your driveway/sidewalk

- Locate & block any animal-accessible attic vents

- Clean any mold/mildew growing on siding

Interior

- Check/replace air conditioning filters

- Check and replace humidifier filters

- Turn the lead edge of fan blades downwards to push cooled air down

- Clear out hair/other debris from sink & tub drains

- Vacuum coils behind refrigerator

Landscaping

- Continue to mow frequently and high to discourage weeds

- Keep up with watering (in the morning is best)

- Inspect your irrigation system for damaged sprinkler heads

- Turn the compost pile and add water if necessary

- Repair fences or gates

- Trim trees in preparation for winter storms

Porch.com is the free home network that connects homeowners and renters with the right home service professionals.

Porch.com is the free home network that connects homeowners and renters with the right home service professionals.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link